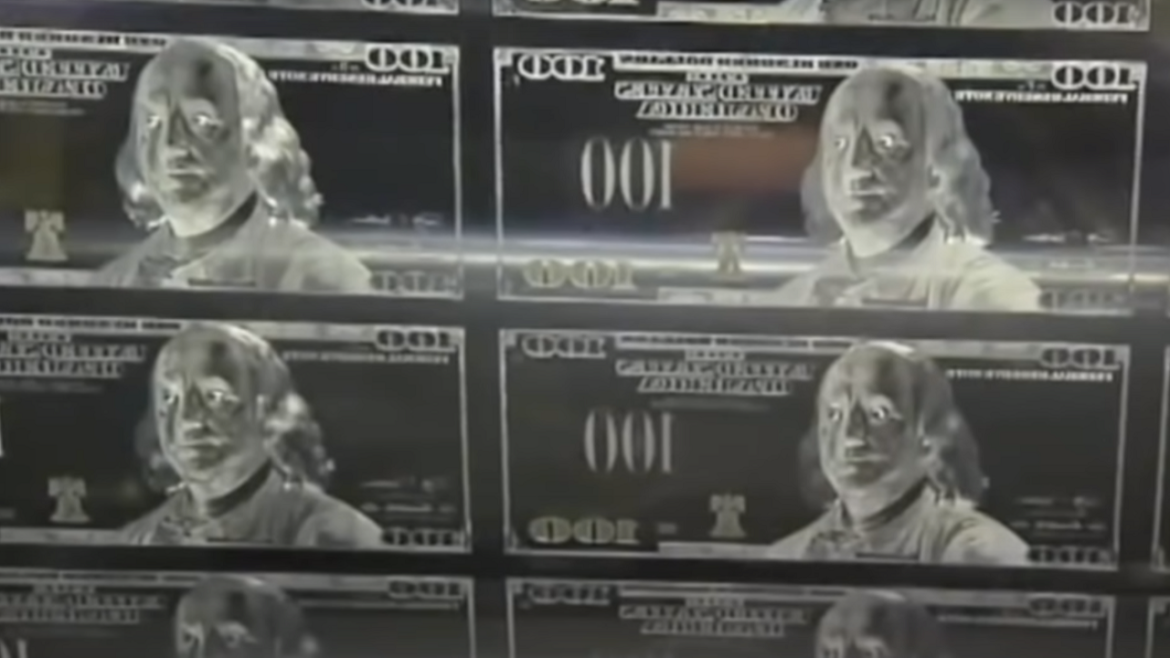

The federal government continues to borrow and spend at a staggering rate. On March 1, the national debt pushed above $28 trillion for the first time. This rate of borrowing wouldn't be possible without the Federal Reserve monetizing the debt through quantitative easing. In practice, the central bank buys U.S. Treasuries on the open market,..

Read moreWant Economic Justice? Break the Federal Monopoly on Money

We hear a lot about income equality in the U.S., but very little about the actual root cause of wealth redistribution - government monetary policy. Through quantitative easing - essentially money printing - the Fed enriches bankers and the political elite while stealing wealth from everyday Americans via currency debasement. Since the creation of the..

Read more